💰 New Taxes, SNAP Mismanagement, and the Need for Real Ethics Reform in Illinois

This week, I’m calling attention to three major issues facing Illinois families: a growing crisis of conscience in government, a fresh wave of tax hikes from Democrat leaders, and another costly case of mismanagement under Governor Pritzker. In my latest video, “Ethics Reform Isn’t Just About Compliance, It’s About Conscience,” I make the case for integrity-driven leadership. Meanwhile, as Democrats push over $1 billion in new taxes—and float a $1.50 delivery tax to cover a Chicago transit bailout—families are being squeezed even harder. And now, because of state mismanagement of the SNAP program, Illinois taxpayers could be forced to pay back $705 million to the federal government.

-Brad

Halbrook: Ethics Reform Isn’t Just About Compliance, It’s About Conscience

Dems Frightening Tax Hikes Hit Illinois Families the Hardest

As fall continues, Illinois families are in for a scare—new taxes. While families manage the pressure of an additional $1 billion in taxes being added by Democrats through the FY2026 budget, now they may be on the hook for the funding gap of the Chicagoland Transit.

The gap is estimated to be as high as $202 million, and Democrats want all of Illinois to pay for it. Their proposal includes a $1.50 delivery tax on every single package and delivery made to homes across Illinois.

Keep reading more here about the other taxes Illinois Democrats play to implement.

Halbrook Sends Condolences to Bailey Family

I am saddened to hear the news that my former House colleague’s son, daughter-in-law, and two grandchildren were tragically killed in a helicopter accident in Montana. My prayers are with the Bailey Family as they navigate this unfathomable devastation.

SNAP Mismanagement Could Cost Illinois Families Even More

Instead of holding his own administration responsible, Gov. Pritzker has continually deflected and blamed the Trump Administration for agency mismanagement issues that are happening right here at home.

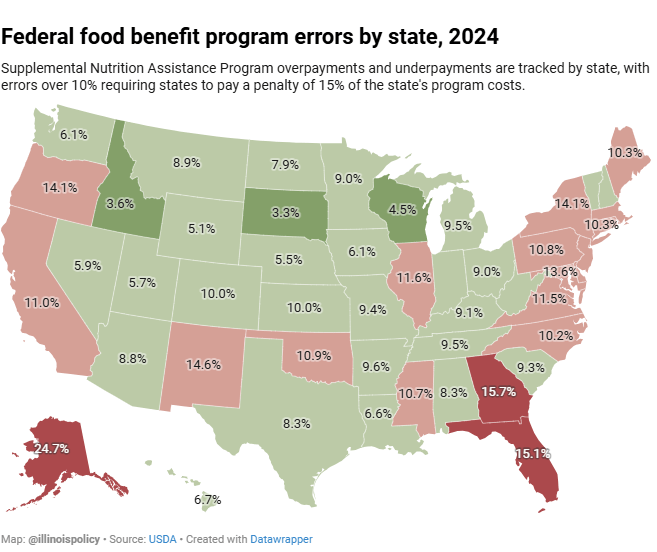

Illinois had a higher error rate than accepted under a new federal law for SNAP in 2024, meaning that if it is not fixed, Illinois taxpayers are on the hook for millions to pay back the federal government.

Under the new federal law, the error rate for SNAP benefits, which is calculated by dividing the total number of incorrect SNAP payments by the total number of SNAP payments, cannot exceed 10% and Illinois had an 11.56% error rate. According to the Governor’s office in August, if the error rate is not addressed, the penalty will cost taxpayers $705 million annually.

Governor Pritzker needs to focus on the issues right here in Illinois, instead of focusing on making national headlines. Illinoisans are taxed out, but the Governor and the Democrats do not seem to care.

Learn more on the background of the SNAP error rate and what the implications of being over the threshold are here.